Everything You Need to Know About the Federal Solar Tax Credit

Page Contents

Written by qualified solar engineer Aniket. Last updated:

The federal Investment Tax Credit (ITC) is a mechanism that allows homeowners or businesses to receive a tax credit equivalent to 26% of their investment cost of a solar energy system. Essentially, this solar tax incentive is equivalent to having a system for a 26% reduced cost.

This value, however, will be reduced to 22% in 2023, and only 10% in 2024, only applicable to commercial systems. If you are about to install or have just installed your solar system, you can apply to the ITC by filling out the Form 5695. All you need to do is enter the details, calculate your solar tax credit on the form and enter the result on your regular Form 1040.

Where to Find the Federal Solar Tax Credit Form?

The application for the credit must be done through the Internal Revenue System’s (IRS) Form no. 5695, which is easily available on the IRS website.

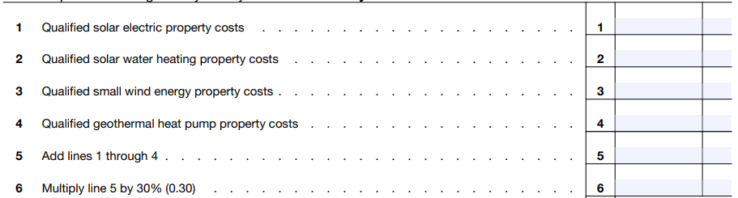

The part I of the form 5695 consists of the ‘Residential Energy Efficiency Property Credit’. It has several lines, each about a certain type of energy saving/generating technology. The first two lines belong to types of solar energy systems. These should be filled in to claim the federal solar tax credit if you have installed or started installation of a solar system in the current or preceding year.

Line number 6 shows the current value of tax credit percentage that can be claimed for a solar system, along with any other or a combination of clean energy systems. As long as you have installed the system in 2020 or later, you can claim a 26% tax credit.

Once you have a final value in the complete IRS form 5695, you can enter that value in the regular IRS Form 1040 for your federal taxes.

The federal tax credit for solar panels is not to be confused with a direct financial assistance incentive. You are not eligible to get a direct reduction in your purchase/installation costs of a solar energy plant at the time of installation, but you save an amount in your coming year’s tax. This amount is equivalent to 26% of your solar system cost, meaning you can not only make a profit from your solar panels by saving on power bills, but also increase its value through the tax grant.

Commonly Asked Questions:

- Who is eligible for the federal tax credits?

Until 2023, all the owners of solar systems or other specified renewable energy systems are eligible for the solar tax grant. This includes homeowners as well as business owners. The only important condition is that you should be the owner of the system.

Solar energy systems under the PPA (power purchase agreement) or leased systems will not get you the tax credit. Instead, the installing company/leasing company becomes eligible for such solar tax credit, since it remains the owner of the system.

In addition to this, the energy efficient property should be owned by you and under use for considerable part of the year. In case of holiday homes, if you do not live there for a significant portion, you could be ineligible for, or receive a lower tax credit for your solar panels. For example, if you use the holiday home for about a quarter of a year, you are eligible for a quarter of the tax credit, which means 25% of the 26%. Therefore, if the system costs $10,000, the 26% value comes down to $2,600 and a quarter of it becomes $650.

But in any case, you can always make back what you paid for your solar panels, thanks to falling prices.

- How does the federal solar tax credit work for me if my tax is lesser than the solar tax credit amount for my system?

It may happen that you have chosen to have an energy efficient home, but your tax liability is lower than the tax credit you are receiving. In that case, you cannot claim the entire credit in one year. You can, however, carry the solar tax credit forward to the next year. If you have received a $3,000 credit and your annual tax is $1500, you can use the tax credit for two consecutive years.

However, if the tax bracket is among the lowermost ones, owing to which you have no or almost zero annual tax liability, the federal solar tax credit for solar panels or any other tech may not be applicable to you. This may particularly be applicable to cases of credit for residential solar energy systems.

In either case, though, your home value will increase and the money you save on power bills mean it is always a good option to opt for solar.

- Which costs can be included under the solar system while applying for a tax credit?

Fortunately, all types of costs incurred in the process of installing your solar system can be considered for the solar tax credit application. This includes costs of consultancy, shipping, actual equipment, tools, the installation cost of solar panels, and nearly everything the solar companies may charge you throughout the process.

Another positive aspect of the tax credit is the fact that it has no upper limit or cap on the cost of solar panels or other systems. This is especially beneficial for industrial/commercial customers who require very large sizes of solar energy systems.

When Does the Federal Solar Tax Credit Expire?

The idea of an energy tax credit for solar energy was first born in 2005 under the ‘Energy Policy Act’ (EPA). The goal of this financial energy policy was to offer tax incentive to promote use of solar power as well as other clean/renewable energy systems to generate electricity on-site, considering the possible implications of climate change.

Initially, the federal solar tax credit expiration year was supposed to be 2007, but it witnessed a series of extensions, partly considering the fact that solar panel prices are high. In 2016, it received an important extension period of 5 years. This federal solar tax credit extension was made considering that the 5-year duration would be sufficient for the solar energy sector to be properly established.

The EPA and Dept. Of Energy have decided to gradually reduce the value of the ITC each year before cancelling it. As of now, the following percentages of tax credits can be claimed as per years (updated):

- 2021: 26%

- 2022: 26%

- 2023: 22%

- 2024: 10% (only applicable to commercial entities)

It is important to note that the for residential solar energy plants customers, the tax credits expire on 31 December 2023. After that the solar tax incentive application will only be accepted by IRS from business owners and at a lowered 10%.

Making the Most of the Program

As the value of available energy tax credits goes down each year, it is wise to make a fast decision with respect to choosing to install solar panels. Fortunately, unlike in the past, you can apply for a solar tax credit as soon as you begin installation of the solar power system. You do not have to wait until your solar panels are up and running.

As the renewable energy sector catches up fast and cost of the systems goes down, most of the solar tax incentives or grants are subject to possible revisions, given the fact that with increasing electricity prices, solar panels are worth the cost. As such, we may soon experience future years with nearly no extra benefits besides the obvious ones of renewable energy such as free, reliable and clean power in the wake of climate change.

References

- About Form 5695 – Internal Revenue Service

- Summary of the Energy Policy Act – Environmental Protection Agency

- Residential and Commercial ITC Factsheets – Office of Energy Efficiency and Renewable Energy

We hope you liked this article. Please rate it or leave us a comment.

Average rating 3.5 / 5. Vote count: 2

No votes so far! Be the first to rate this post.