Are Solar Panels Worth It for Your Home?

Page Contents

Written by qualified solar engineer Leonardo. Last updated:

If you have a good site for solar panels then they will be worth the investment. Every $1,000 invested upfront will yield over $3,000 in savings during the next 25 years. Solar panels are like any other investment, where capital is spent in exchange for a greater benefit. In the US, you can expect an upfront cost of around $3 for every watt of installed capacity. This means a 6-kilowatt solar system will cost around $18,000, although prices can change slightly depending on the provider and location.

The first step for knowing whether or not solar panels are worth it is getting detailed solar offers with financial projections. The payback period depends on the monthly savings achieved, and this is determined by two main factors:

- The solar electricity production per year.

- The local price of electricity.

If you have a solar energy system that produces 10,000 kWh per year, and your local power company charges 20 cents per kilowatt hour, you save $2,000 per year. However, someone who generates 16,000 kWh and pays 12.5 cents per kWh will also save $2,000 per year.

Other than the solar installation costs and electricity rates, you must consider any local incentives. These normally take the form of tax benefits or cash rebates. They reduce the net cost of solar panels, leading to a higher return on investment. Some states also have Solar Renewable Energy Certificates (SREC), which give you extra cash for every 1000 kWh produced by your home solar system.

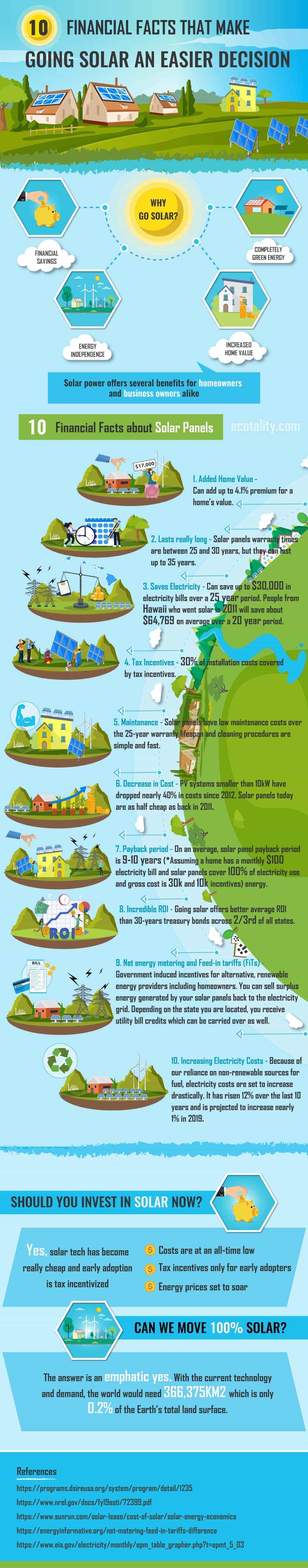

10 Financial Facts That Make Going Solar an Easier Decision (Infographic)

You can use this image on your website by copying the code below:

The Costs Involved When Installing Solar Panels?

The first step to analyze solar power as an investment is factoring in how much solar panels cost. As previously mentioned, you can expect an initial investment of $3 per watt. However, this cost can be covered more easily if you look for financing options. If you have access to a low-interest loan, you can go solar with money from a bank, and then pay the debt with solar savings.

Calculating the cost of installing solar panels requires a professional inspection of each property. There are different types of roof structures, and their slope also varies. Since these factors affect the difficulty of solar panel roof installations, they must be considered by solar companies.

The use of solar shingles has been increasing, and they allow the construction of roofs with embedded solar cells. They are over two times more expensive than panels, leading to a longer payback period. However, they are a viable option if you are considering a new home, since you don’t have to pay for a separate roof.

To estimate the roof area required for the project, the first step is knowing how many solar panels you need. For example, assume your solar installer suggests a capacity of 6 kilowatts, or 6000 watts. If each panel has a capacity of 250 watts, you need 24. The panels are normally smaller than 20 square feet each, which means this project will use less than 480 square feet.

Which Are the Incentives for Solar Panels?

If you have access to solar incentives, the net cost of your system will be less than the sales price in the solar offers. There are three main types of incentives that reduce the cost of going solar:

- Tax credits

- Tax exemptions

- Cash rebates

Tax exemptions and credits may seem similar, but there is an important difference. When solar energy systems are not subject to a tax that would normally apply, you have an exemption. On the other hand, when you can deduce part of a solar investment from your tax burden, you have a credit. The two types of tax benefits work differently, but their benefit is the same: paying less to own solar panels.

Cash rebates have nothing to do with taxes, since they are simply payments you get for going solar. Rebates are normally offered by local government programs or electricity companies. When both rebates and tax credits are available, the credits are calculated with the net cost after subtracting rebates.

Solar power systems become more affordable each year, which may lead to the conclusion that you should wait for lower prices. However, there is a catch: there is a 30% federal tax credit that ends in 2019, and it will be reduced to 26% and 22% in 2020 and 2021. Once the year 2021 ends, this benefit becomes zero. While the sales price of solar panel systems will continue to decrease, the net price after the tax deduction will increase. This means you are likely to pay more in the short term if you wait, even if the cost of panels continues to drop.

To summarize, the cost of installing a solar system is equivalent to the sales price from your solar installer, minus any incentives available.

How Much Money Do Solar Panels Save?

As previously mentioned, the savings achieved by solar panels depend on how much energy they produce and the local electricity cost. While panels are guaranteed to save money, the exact amount depends on these factors.

- There is a common misconception that solar energy systems are only useful in sunny places. However, you can get decent savings in place with moderate sunshine and expensive electricity.

- New York is a good example: the state is not very sunny, but local electricity prices are among the highest in the country. Solar power is growing fast in the state, since the dollar savings are high even with modest sunshine.

Two solar power systems of the same capacity in kilowatts can have different results depending on where they are installed. This is a consequence of the way solar panels work: they only operate at peak capacity when they get full sunshine. At other times, the panels only deliver a fraction of their rated capacity. This is simply how the technology works, and not a quality issue.

Installing efficient solar panels pays off, since they convert a larger portion of sunshine into electricity, which is reflected as extra savings in your electricity bill. It’s important to consider that they last a long time; more than 20 years for high-quality brands.

Most solar incentives reduce the ownership cost, but there is a specific type that increases the savings achieved: Solar Renewable Energy Certificates (SREC). These programs can be summarized as follows:

- If you own a solar system, you get one SREC for every 1000 kWh generated.

- States that have SREC programs also have minimum clean energy requirements for utility companies and large-scale consumers. If these organizations don’t generate or purchase enough clean energy to reach the target, they can fill the gap by purchasing SRECs.

- By selling SRECs, you get extra cash beyond the solar power savings.

Assume you live in a state where electricity costs 15 cents/kWh and SRECs are sold at $150 each. For every 1000 kWh generated, you save $150 on power bills and get a SREC that sells for an extra $150. The total benefit for every 1000 kWh is $300, which is like saving 30 cents per kWh.

When Is Solar Power a Good Investment?

Are solar panels worth it? As discussed in this article, the answer to this question depends on several factors. Some of them can be controlled, while others are external.

The ideal location for solar power would be a sunny state with expensive electricity and abundant incentives, but this combination is rare. New York is a good example of a state with many favorable conditions, in spite of not being very sunny:

- The 30% federal tax credit is combined with a 25% state credit, for a total of 55%. In other words, you can deduct more than half of the solar investment from your tax burden.

- There is a sales tax exemption for solar systems, and a property tax exemption for the increase in home value after installing them.

- The NY-Sun rebate program covers residential solar systems, as well as commercial and industrial installations.

- Local electricity prices are among the highest in the country, exceeding 20 cents per kWh in some tariff schedules.

- There is a net metering program for solar installations up to 25 kW. Any surplus electricity fed back to the grid is credited at retail price on the next power bill.

These are excellent conditions to buy solar panels: their net cost is reduced, and the savings per kWh are high. The lack of sunshine is not an issue in this case, since there are so many financial benefits for going solar.

The best solar companies will provide financial projections with their offers, considering local electricity prices and including any incentives available. Solar power can offer a payback period below 5 years with favorable conditions, which is great for an investment that lasts over 20 years. A solar calculator can estimate your costs and benefits, but only a professional assessment provides an accurate budget and savings estimate.

Keep in mind: you can go solar without assuming the full upfront cost by taking a loan or leasing the solar system. Loan financing makes sense when the terms are favorable, and debt payments are lower than the energy savings. Leasing has the advantage of transferring maintenance responsibilities to the provider, but you lose owner benefits like rebates and tax benefits.

References

- Solar Investment tax Credit (ITC) – SEIA

- Making Solar Affordable for all New Yorkers – NYSERDA

- Net Metering – SEIA

- Solar Renewable Energy Certificates – SRECTrade

We hope you liked this article. Please rate it or leave us a comment.

Average rating 4.4 / 5. Vote count: 9

No votes so far! Be the first to rate this post.